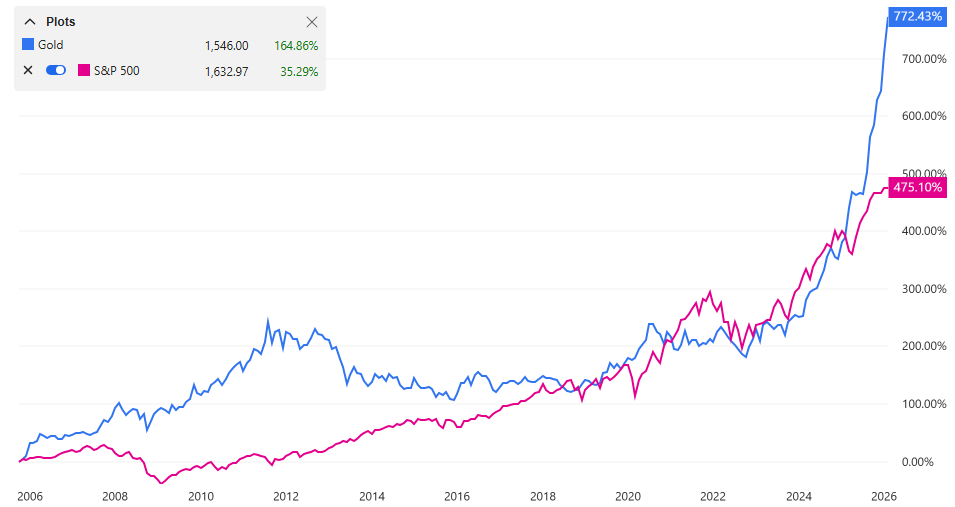

Is gold a good investment? Since January 2024, the price of an ounce of gold has increased from $2,000 to over $5,000. For anyone who invested during that time, the answer is clearly yes.

However, many people don’t buy gold because they think it’s a good investment right now, but because they consider it a safe storage of value when the rest of the economy does badly. They reason that if there’s an economic collapse, hyperinflation, or societal breakdown, dollars and stocks will not be worth much, but gold will keep its value. That’s probably wrong.

Just as with dollars, gold only has as much value as people assign to it. Imagine there’s a severe crisis and people use trust in the monetary system. Your dollars aren’t worth anything. It’s not obvious that society will now consider gold a better currency than dollars, but for the sake of argument, let’s assume that’s the case. Those who have stockpiled gold will try to use it to buy the things they need, and this will increase the metal’s supply. There is no reason to believe that gold isn’t subject to the laws of supply or demand. Gold may decrease in value just like any other currency.

To prepare for a severe crisis, stockpiling items that will actually be useful, like a few weeks’ worth of food or some solar panels, seems like a better idea.

One final caveat: If you’re taking investment advice from a blog like this one and it doesn’t work out, you’re an idiot and it’s your own fault.